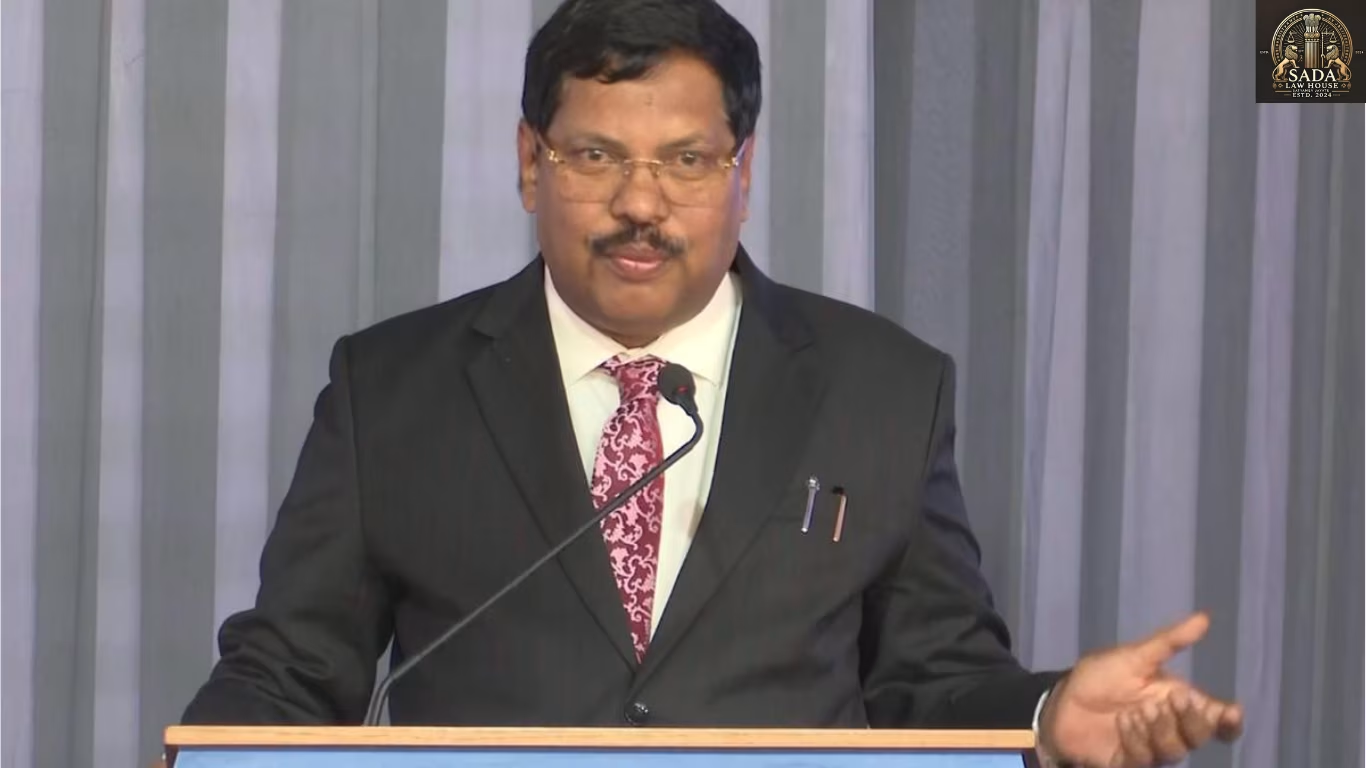

Government Appoints Shirish Chandra Murmu as Deputy Governor of RBI: A Move Ahead of Critical Policy Review

- Shristi Singh

- 30 September 2025

Introduction

In a major development for India’s financial sector, the Government of India has appointed senior bureaucrat and economist Shirish Chandra Murmu as the new Deputy Governor of the Reserve Bank of India (RBI). His appointment, effective from October 9, 2025, comes just days before the Monetary Policy Committee (MPC) meeting, where crucial decisions on inflation and economic growth are expected.

Background

The Deputy Governor’s role at the RBI is of high strategic importance, overseeing areas such as monetary policy, banking supervision, and financial regulation. Murmu, a 1979-batch IAS officer from the Gujarat cadre, brings decades of administrative experience. He previously served as the first Lieutenant Governor of Jammu & Kashmir after Article 370’s abrogation, and as Comptroller and Auditor General (CAG) of India, where his financial oversight role was widely commended.

Key Developments

The Ministry of Finance

vannounced Murmu’s appointment on September 29, 2025.

He will replace Rajeshwar Rao, who retires on October 8 after guiding the RBI during the pandemic.

Murmu’s portfolios within the RBI are yet to be finalized, but he is expected to handle financial supervision and internal regulation.

His appointment precedes the MPC meeting scheduled from October 1–3, 2025, where interest rate decisions will be taken amid high inflation.

Market reactions were positive, with the Sensex rising by 200 points, reflecting investor confidence in policy continuity.

Issues

Economic pressures: Inflation stood at 6.4% in August 2025, above RBI’s target range. Growth forecasts have dipped from 6.7% to 6.2%.

Global volatility: Rising crude oil prices, a weakening rupee, and global financial uncertainty continue to weigh on India’s economy.

RBI–government dynamics: Historically, tensions over autonomy have surfaced; Murmu’s administrative and political experience may help balance this relationship.

Current Status

Murmu officially assumes office on October 9, 2025 for a three-year term. His immediate challenge will be contributing to RBI’s inflation–growth balancing act in the upcoming MPC meeting. Experts suggest RBI may keep the repo rate unchanged at 6.5% while signaling caution in future moves.

Conclusion

Shirish Chandra Murmu’s appointment as Deputy Governor of the RBI signals the government’s intent to strengthen central bank leadership with experienced administrators. His mix of governance, fiscal oversight, and political sensitivity equips him to navigate India’s pressing economic challenges. As the RBI faces tough policy choices, Murmu’s role will be pivotal in shaping India’s financial stability and economic trajectory ahead of the 2026 general elections.