ED Probe Deepens: Legal Scrutiny on Care Health ESOPs and Senior Advocate’s Role in Corporate Governance Case

- KASHISH JAHAN

- 21 June 2025

The Enforcement Directorate’s probe into Care Health Insurance’s ESOP issuance deepens as senior advocate Pratap Venugopal is summoned. The investigation raises concerns over legal accountability, corporate governance, and regulatory oversight in India.

ED Investigates Care Health ESOPs Amid Corporate Governance Concerns

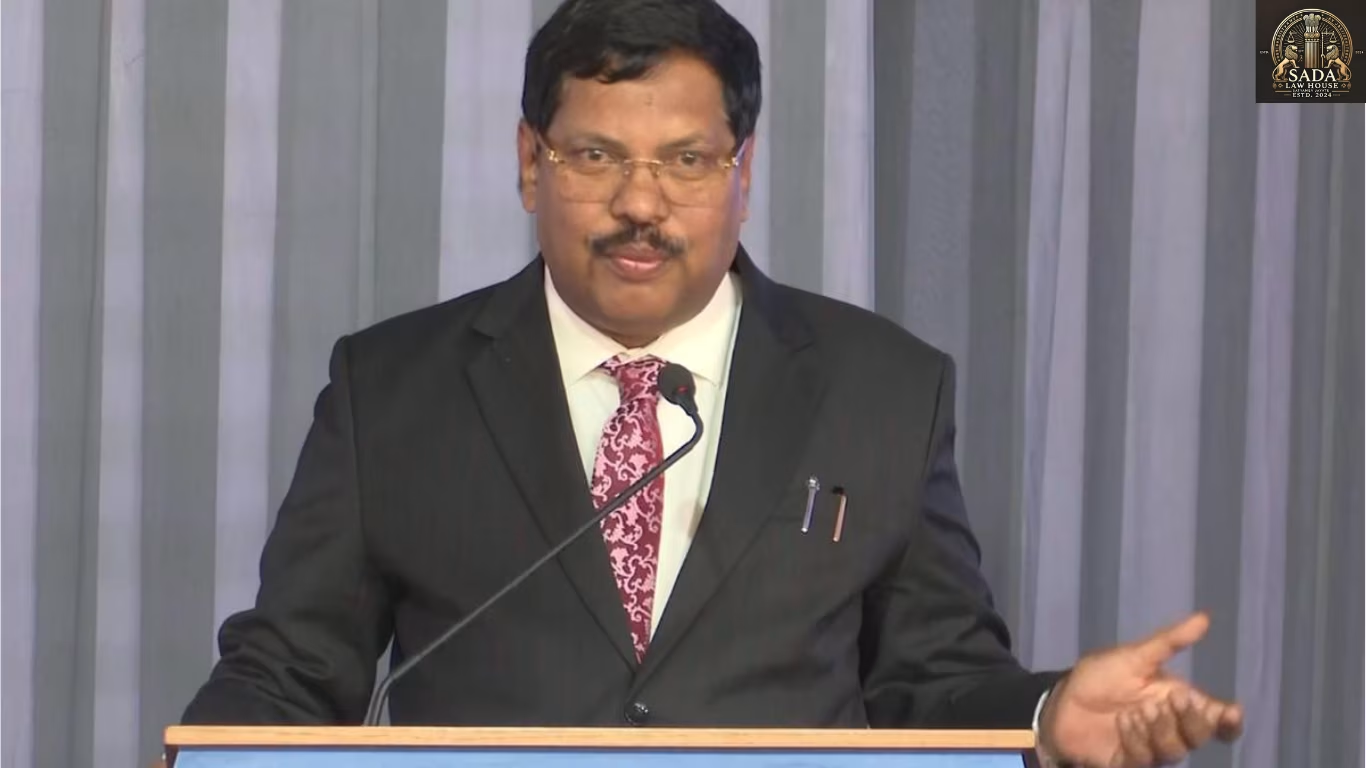

The Enforcement Directorate (ED) has intensified its investigation into alleged irregularities surrounding the Employee Stock Option Plan (ESOP) issued by Care Health Insurance. The agency has summoned prominent senior advocate Pratap Venugopal for questioning regarding his legal involvement in the matter. This move marks a pivotal moment in what is emerging as a landmark case in Indian corporate governance.

Background: Legal Framework and the Role of External Counsel

At the core of the case is the allocation of ESOPs to Rashmi Saluja, the Executive Chairperson of Religare Enterprises. The ED is examining whether the allotment violated Indian company law, SEBI regulations, or the Prevention of Money Laundering Act, 2002 (PMLA).

The investigation includes scrutiny of legal opinions provided by external advisors, including Venugopal, to determine if they contributed to or justified the ESOP distribution under question.

Who Is Involved in the Controversy?

The investigation casts a wide net over several key stakeholders:

Rashmi Saluja: Recipient of the ESOPs being scrutinized.

Pratap Venugopal: Legal advisor summoned for his opinion on the ESOP process.

Care Health Insurance: Issuer of the controversial ESOPs.

Religare Enterprises: Parent company facing corporate governance questions.

This case raises pressing concerns about the accountability of legal counsel in major boardroom decisions and how such decisions align with ethical and legal standards.

Key Developments in the ED’s ESOP Probe

The ED has officially summoned Pratap Venugopal to clarify his legal role in the ESOP allocation.

Investigators are reviewing internal documentation, board approvals, and legal counsel to determine if any statutory rules were circumvented.

The probe is expanding to examine the effectiveness of the company’s compliance frameworks and board oversight mechanisms.

Implications for Corporate India and Legal Advisory Roles

This case is not just about one company. It underscores a broader shift in regulatory focus — holding external legal advisors and corporate boards accountable for potentially enabling financial misconduct.

Experts believe this may lead to more cautious structuring of ESOPs, with increased documentation and legal compliance in the future.

A senior regulatory official noted:

“Legal advice cannot become a shield for decisions that might violate the spirit of the law. There is a duty to uphold corporate integrity.”

Legal and Constitutional Insights

The controversy also touches upon the intersection of legal privilege and accountability. While Article 19(1)(g) of the Indian Constitution protects the right to practice a profession, this right is subject to reasonable restrictions in the interest of public order and financial integrity.

The ED’s intensified approach highlights the evolving legal landscape in India, where regulatory bodies are taking a firmer stance on corporate fraud, misuse of financial instruments, and legal facilitation of questionable decisions.