The eligibility of extended limitation and penalties under Central Excise law in cases of alleged duty evasion by M/s Reliance Industries, based on bona fide classification disputes.

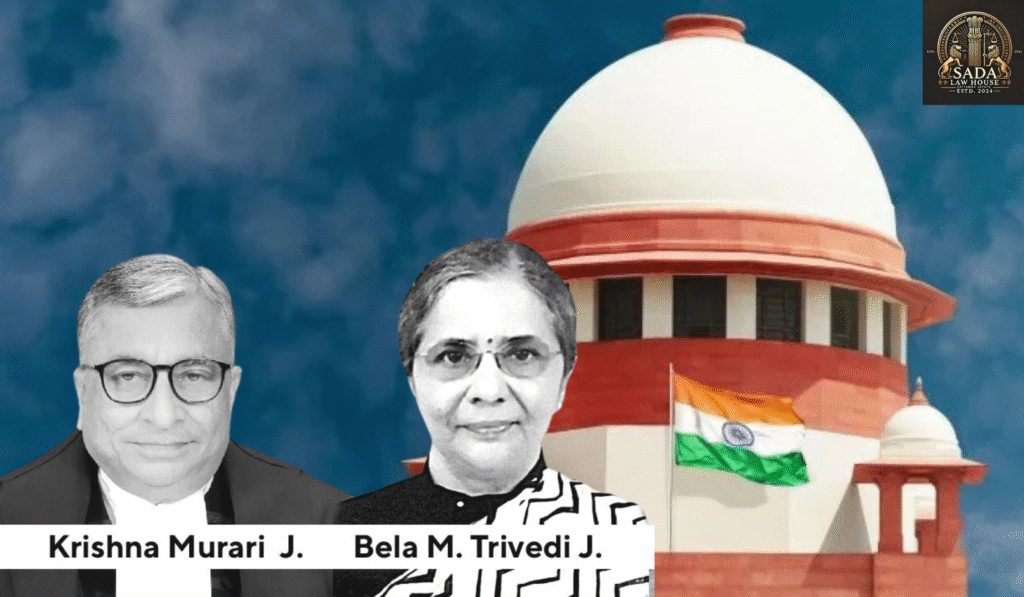

Trending Today The eligibility of extended limitation and penalties under Central Excise law in cases of alleged duty evasion by M/s Reliance Industries, based on bona fide classification disputes. Bound to Maintain Wife for Life: Punjab & Haryana High Court Upholds Maintenance Order Against 86-Year-Old Paralysed Veteran Supreme Court of India Allows Death Penalty Challenge Through Article 32 Petitions Telangana High Court Rejects Wife’s ₹90 Lakh Alimony Plea, Dismisses Impotency Claim LEGAL JOB OPPORTUNITY AT LEXCLAIM ADVOCATES, DELHI LEGAL INTERNSHIP OPPORTUNITY AT UMBRELLA LEGAL, MUMBAI LEGAL JOB OPPORTUNITY AT THE OFFICE OF NITIN GOEL, DELHI LEGAL INTERNSHIP OPPORTUNITY AT KOHLI AND KOHLI LAW ASSOCIATES, GURUGRAM LEGAL JOB OPPORTUNITY AT POOVAYYA & CO., BENGALURU & DELHI A New Era of Political Renewal: Young Democrats Challenge the Old Guard THE COMMISSIONER, CENTRAL EXCISE AND CUSTOMS AND ANOTHER v. M/S RELIANCE INDUSTRIES LTD. Justice Krishna Murari, Justice Bela M. Trivedi 04 July 2023 Introduction The case The Commissioner, Central Excise and Customs and Another v. M/s Reliance Industries Ltd. (2023) concerned the interpretation of Section 11A of the Central Excise Act, 1944. The key issue was whether extended limitation and penalties could be invoked in cases where an assessee followed a bona fide classification or valuation method that was later found to be incorrect. Reliance Industries was accused of suppressing facts and misclassifying goods to evade excise duty, while Reliance argued that its actions were guided by prevailing judicial interpretation at the time. Facts of the Case Reliance Industries was alleged to have misclassified/undervalued goods by not including duty benefits received through transfer of advance licenses from its customers. The Excise Department issued a Show Cause Notice on 28.09.2005, invoking the extended period of limitation under Section 11A(1) proviso of the Central Excise Act. Reliance argued that it followed the view taken by the CESTAT in IFGL Refractories Ltd. (2001), which held that such duty benefits were not part of assessable value. That view was later overturned by the Supreme Court in 2005. The Commissioner confirmed the demand (2006), but the CESTAT allowed Reliance’s appeal (2009), holding there was no suppression and the dispute was revenue-neutral. The Revenue challenged this order before the Supreme Court. Issue of the Case Whether Reliance Industries could be subjected to the extended limitation period and penalties under Section 11A on grounds of alleged suppression of facts, despite acting on a bona fide interpretation supported by CESTAT’s then-prevailing decision? Petitioner’s (Revenue) Arguments Reliance deliberately misclassified goods, causing revenue loss. Suppression of material facts with intent to evade duty justified extended limitation under Section 11A(4). Reliance’s reliance on the CESTAT ruling in IFGL Refractories could not absolve liability once the Supreme Court overturned it. Self-assessment required strict compliance; misstatement or omission, even if based on contrary interpretation, amounts to suppression. Respondent’s (Reliance Industries) Arguments Classification/valuation was based on a bona fide interpretation of law supported by the CESTAT’s binding decision at the relevant time. All relevant information was disclosed in statutory returns; there was no fraud, suppression, or intent to evade. The dispute was revenue-neutral, as customers could claim CENVAT credit. A mere difference of opinion on interpretation cannot justify invoking the extended limitation period. Judgment (Supreme Court, 04 July 2023) The Supreme Court dismissed the Revenue’s appeals and upheld the CESTAT order in favor of Reliance. Held that no deliberate suppression, fraud, or misstatement was proved against Reliance. Reliance acted on a bona fide belief based on the CESTAT ruling in IFGL Refractories (2001), which held the field until reversed in 2005. Extended limitation under Section 11A(1) proviso requires deliberate intent to evade duty, not mere adoption of an interpretation later found incorrect. The absence of a specific disclosure requirement for deemed exports in ER-1 returns also meant there was no suppression. Appeals were dismissed as time-barred, and no penalties were applicable. Conclusion The Supreme Court reaffirmed that extended limitation and penalties under Central Excise law cannot be invoked in genuine classification or valuation disputes where the assessee acts on a bona fide interpretation supported by judicial precedent. Mere disagreement or later change in legal interpretation does not amount to suppression or fraud. The decision safeguards taxpayers against arbitrary penalties in cases involving genuine interpretative disputes. Leave a Reply Cancel Reply Logged in as Aliya Ansari. Edit your profile. Log out? Required fields are marked * Message* Case Laws The eligibility of extended limitation and penalties under Central Excise law in cases of alleged duty evasion by M/s Reliance Industries, based on bona fide classification disputes. Aliya Ansari • August 28, 2025 • Case law • No Comments K Umadevi vs Government of Tamil Nadu 2025: Supreme Court Recognizes Maternity Leave as Fundamental Reproductive Right Sada Law • June 20, 2025 • Case law • No Comments Supreme Court Judgment on Affinity Test in Scheduled Tribe Verification: Affinity Test Not Mandatory for ST Claims Sada Law • June 20, 2025 • Case law • No Comments 1 2 3 … 5 Next »